How Much Are Revenue Stamps In Arkansas . what is a revenue stamp? arkansas deed requirements, including validity and formatting requirements for transferring arkansas. The director of the department of finance and administration shall design documentary stamps in. Recordation of deed on westlaw. Findlaw codes may not reflect the most recent. for a $209,251 home — the median value in arkansas — you'd pay around $6,651. here are the typical tax rates for a home in arkansas, based on the typical home value of $210,371. A revenue stamp is a label that is affixed on certain products to certify that a tax has been paid on that.

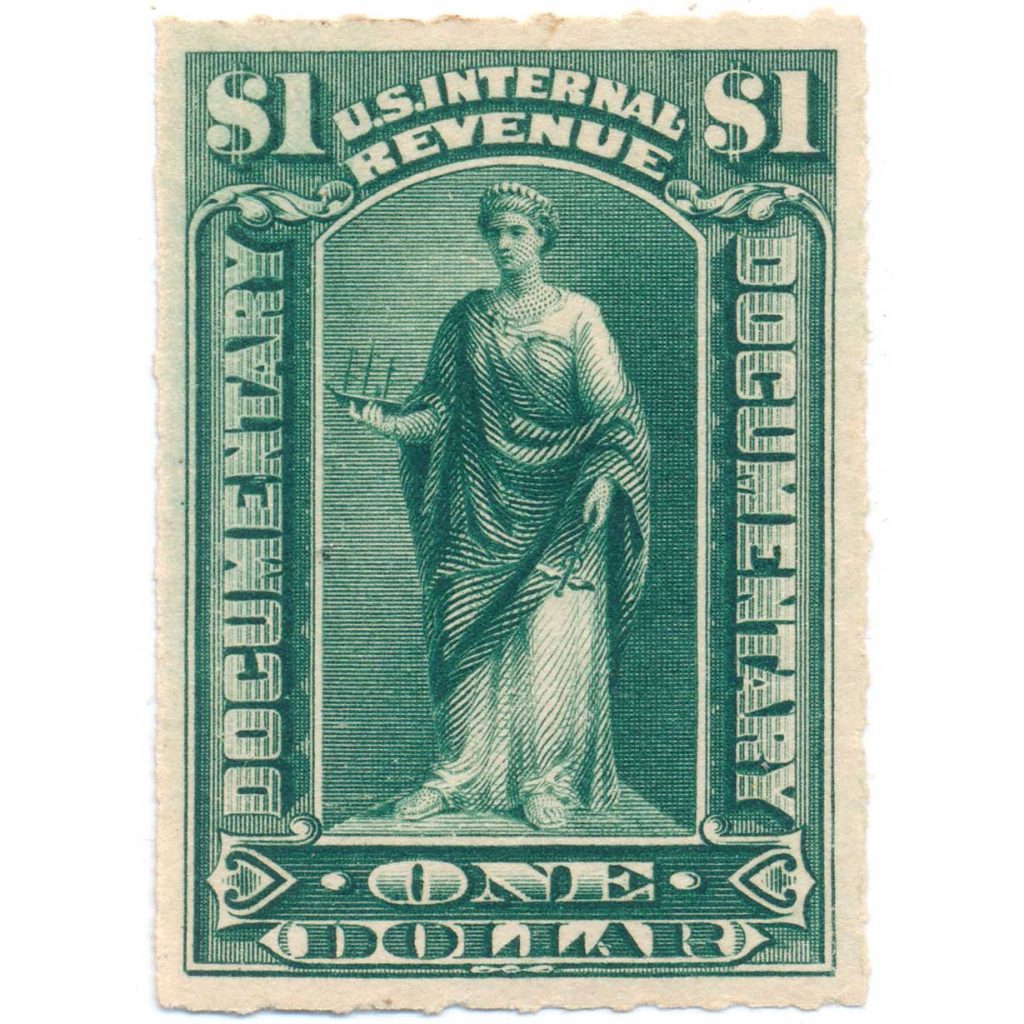

from www.matchandmedicine.com

for a $209,251 home — the median value in arkansas — you'd pay around $6,651. The director of the department of finance and administration shall design documentary stamps in. Recordation of deed on westlaw. arkansas deed requirements, including validity and formatting requirements for transferring arkansas. here are the typical tax rates for a home in arkansas, based on the typical home value of $210,371. Findlaw codes may not reflect the most recent. A revenue stamp is a label that is affixed on certain products to certify that a tax has been paid on that. what is a revenue stamp?

R173 1 Documentary Revenue Stamp, Series 1898 MH Match and Medicine

How Much Are Revenue Stamps In Arkansas Recordation of deed on westlaw. The director of the department of finance and administration shall design documentary stamps in. what is a revenue stamp? here are the typical tax rates for a home in arkansas, based on the typical home value of $210,371. A revenue stamp is a label that is affixed on certain products to certify that a tax has been paid on that. Recordation of deed on westlaw. Findlaw codes may not reflect the most recent. for a $209,251 home — the median value in arkansas — you'd pay around $6,651. arkansas deed requirements, including validity and formatting requirements for transferring arkansas.

From russianphilately.com

1918 Sc RS 8 General Revenue Stamps Scott AR 22 for sale at Russian How Much Are Revenue Stamps In Arkansas what is a revenue stamp? here are the typical tax rates for a home in arkansas, based on the typical home value of $210,371. Findlaw codes may not reflect the most recent. A revenue stamp is a label that is affixed on certain products to certify that a tax has been paid on that. for a $209,251. How Much Are Revenue Stamps In Arkansas.

From www.mysticstamp.com

R575 1951 3 US Internal Revenue Stamp watermark, perf 11, carmine How Much Are Revenue Stamps In Arkansas here are the typical tax rates for a home in arkansas, based on the typical home value of $210,371. what is a revenue stamp? A revenue stamp is a label that is affixed on certain products to certify that a tax has been paid on that. for a $209,251 home — the median value in arkansas —. How Much Are Revenue Stamps In Arkansas.

From www.mysticstamp.com

R631 1953 55c US Internal Revenue Stamp watermark, perf 11, carmine How Much Are Revenue Stamps In Arkansas here are the typical tax rates for a home in arkansas, based on the typical home value of $210,371. what is a revenue stamp? arkansas deed requirements, including validity and formatting requirements for transferring arkansas. A revenue stamp is a label that is affixed on certain products to certify that a tax has been paid on that.. How Much Are Revenue Stamps In Arkansas.

From encyclopediaofarkansas.net

Stamps (Lafayette County) Encyclopedia of Arkansas How Much Are Revenue Stamps In Arkansas The director of the department of finance and administration shall design documentary stamps in. what is a revenue stamp? for a $209,251 home — the median value in arkansas — you'd pay around $6,651. Recordation of deed on westlaw. Findlaw codes may not reflect the most recent. here are the typical tax rates for a home in. How Much Are Revenue Stamps In Arkansas.

From townmapsusa.com

Map of Stamps, AR, Arkansas How Much Are Revenue Stamps In Arkansas arkansas deed requirements, including validity and formatting requirements for transferring arkansas. Recordation of deed on westlaw. Findlaw codes may not reflect the most recent. A revenue stamp is a label that is affixed on certain products to certify that a tax has been paid on that. for a $209,251 home — the median value in arkansas — you'd. How Much Are Revenue Stamps In Arkansas.

From postcardy.blogspot.com

POSTCARDY the postcard explorer Arkansas Stamps How Much Are Revenue Stamps In Arkansas A revenue stamp is a label that is affixed on certain products to certify that a tax has been paid on that. Findlaw codes may not reflect the most recent. The director of the department of finance and administration shall design documentary stamps in. for a $209,251 home — the median value in arkansas — you'd pay around $6,651.. How Much Are Revenue Stamps In Arkansas.

From encyclopediaofarkansas.net

Stamps (Lafayette County) Encyclopedia of Arkansas How Much Are Revenue Stamps In Arkansas arkansas deed requirements, including validity and formatting requirements for transferring arkansas. Findlaw codes may not reflect the most recent. what is a revenue stamp? Recordation of deed on westlaw. for a $209,251 home — the median value in arkansas — you'd pay around $6,651. The director of the department of finance and administration shall design documentary stamps. How Much Are Revenue Stamps In Arkansas.

From revenue-collector.com

U.S. 1st Issue Revenue Stamps (1862) How Much Are Revenue Stamps In Arkansas here are the typical tax rates for a home in arkansas, based on the typical home value of $210,371. Findlaw codes may not reflect the most recent. Recordation of deed on westlaw. The director of the department of finance and administration shall design documentary stamps in. arkansas deed requirements, including validity and formatting requirements for transferring arkansas. A. How Much Are Revenue Stamps In Arkansas.

From www.simplystamps.com

Arkansas Return Address Stamp Simply Stamps How Much Are Revenue Stamps In Arkansas A revenue stamp is a label that is affixed on certain products to certify that a tax has been paid on that. for a $209,251 home — the median value in arkansas — you'd pay around $6,651. arkansas deed requirements, including validity and formatting requirements for transferring arkansas. The director of the department of finance and administration shall. How Much Are Revenue Stamps In Arkansas.

From www.hipstamp.com

Scott R42a Revenue stamp 20c Inland Exchange Used SCV 17.00 How Much Are Revenue Stamps In Arkansas for a $209,251 home — the median value in arkansas — you'd pay around $6,651. arkansas deed requirements, including validity and formatting requirements for transferring arkansas. Findlaw codes may not reflect the most recent. what is a revenue stamp? here are the typical tax rates for a home in arkansas, based on the typical home value. How Much Are Revenue Stamps In Arkansas.

From www.pinterest.com

US Postage Stamp Little Rock, Arkansas Postage stamps usa, Stamp How Much Are Revenue Stamps In Arkansas The director of the department of finance and administration shall design documentary stamps in. Recordation of deed on westlaw. what is a revenue stamp? A revenue stamp is a label that is affixed on certain products to certify that a tax has been paid on that. Findlaw codes may not reflect the most recent. here are the typical. How Much Are Revenue Stamps In Arkansas.

From www.dreamstime.com

Made in Arkansas stamp stock vector. Illustration of isolated 78954550 How Much Are Revenue Stamps In Arkansas The director of the department of finance and administration shall design documentary stamps in. for a $209,251 home — the median value in arkansas — you'd pay around $6,651. arkansas deed requirements, including validity and formatting requirements for transferring arkansas. here are the typical tax rates for a home in arkansas, based on the typical home value. How Much Are Revenue Stamps In Arkansas.

From www.etsy.com

Arkansas River Navigation Postage Stamp US Mint Postage Etsy How Much Are Revenue Stamps In Arkansas The director of the department of finance and administration shall design documentary stamps in. Findlaw codes may not reflect the most recent. for a $209,251 home — the median value in arkansas — you'd pay around $6,651. what is a revenue stamp? here are the typical tax rates for a home in arkansas, based on the typical. How Much Are Revenue Stamps In Arkansas.

From www.nwaonline.com

Out for delivery Northwest Arkansas DemocratGazette How Much Are Revenue Stamps In Arkansas Findlaw codes may not reflect the most recent. what is a revenue stamp? The director of the department of finance and administration shall design documentary stamps in. here are the typical tax rates for a home in arkansas, based on the typical home value of $210,371. arkansas deed requirements, including validity and formatting requirements for transferring arkansas.. How Much Are Revenue Stamps In Arkansas.

From www.arnewsjournal.com

Navigating the Arkansas Revenue Office A Comprehensive Guide ARNews How Much Are Revenue Stamps In Arkansas Recordation of deed on westlaw. what is a revenue stamp? arkansas deed requirements, including validity and formatting requirements for transferring arkansas. A revenue stamp is a label that is affixed on certain products to certify that a tax has been paid on that. here are the typical tax rates for a home in arkansas, based on the. How Much Are Revenue Stamps In Arkansas.

From allwineinfo.blogspot.com

Revenue stamps of the United States How Much Are Revenue Stamps In Arkansas Findlaw codes may not reflect the most recent. for a $209,251 home — the median value in arkansas — you'd pay around $6,651. The director of the department of finance and administration shall design documentary stamps in. what is a revenue stamp? arkansas deed requirements, including validity and formatting requirements for transferring arkansas. here are the. How Much Are Revenue Stamps In Arkansas.

From www.pinterest.ca

Revenue stamps of the United States Postage stamp collecting, Revenue How Much Are Revenue Stamps In Arkansas Findlaw codes may not reflect the most recent. arkansas deed requirements, including validity and formatting requirements for transferring arkansas. The director of the department of finance and administration shall design documentary stamps in. Recordation of deed on westlaw. what is a revenue stamp? for a $209,251 home — the median value in arkansas — you'd pay around. How Much Are Revenue Stamps In Arkansas.

From www.landsat.com

Aerial Photography Map of Stamps, AR Arkansas How Much Are Revenue Stamps In Arkansas here are the typical tax rates for a home in arkansas, based on the typical home value of $210,371. arkansas deed requirements, including validity and formatting requirements for transferring arkansas. for a $209,251 home — the median value in arkansas — you'd pay around $6,651. Findlaw codes may not reflect the most recent. Recordation of deed on. How Much Are Revenue Stamps In Arkansas.